| Frontiers | 您所在的位置:网站首页 › inflowing › Frontiers |

Frontiers

ORIGINAL RESEARCH article

Front. Energy Res., 11 January 2022Sec. Sustainable Energy Systems

Volume 9 - 2021 |

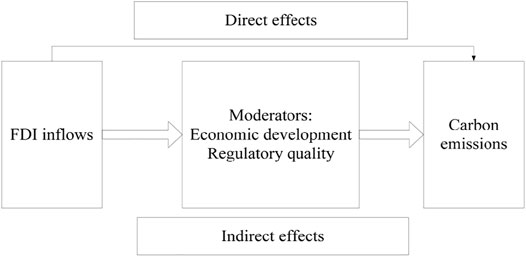

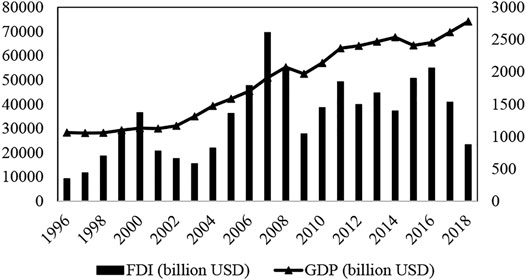

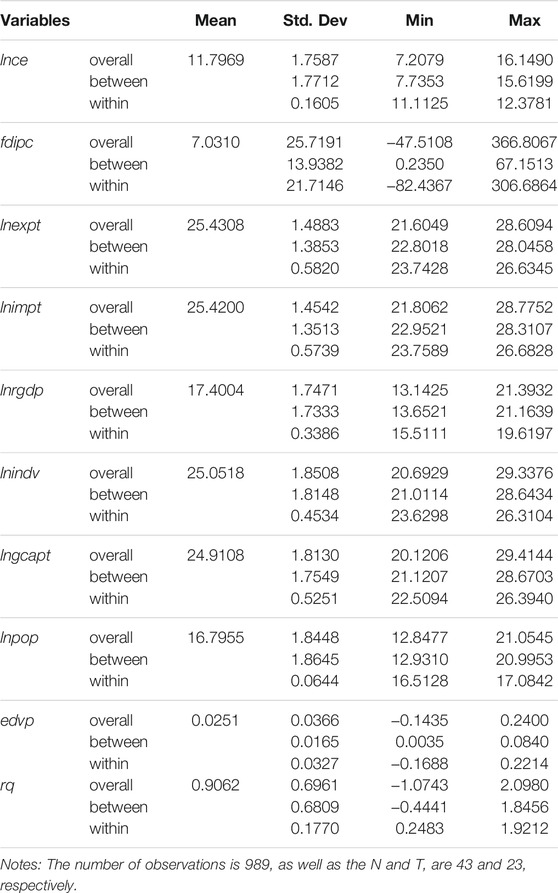

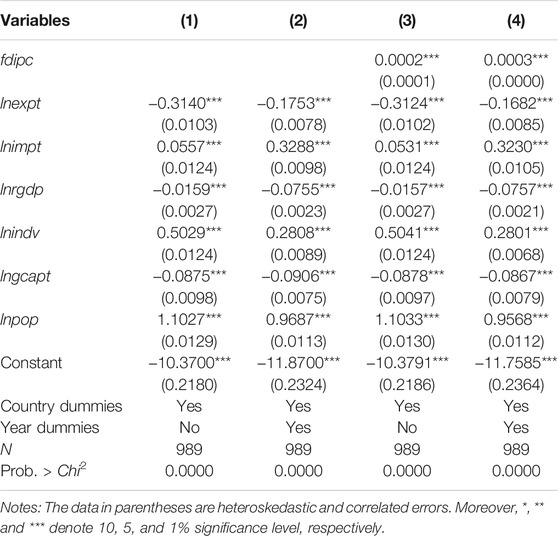

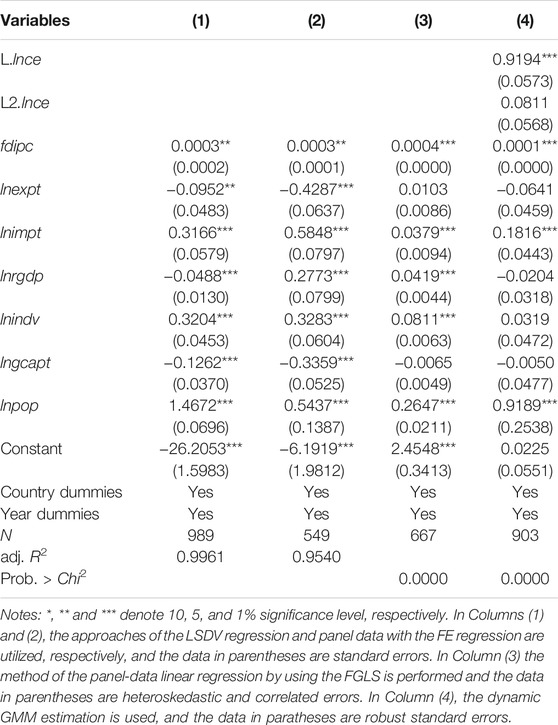

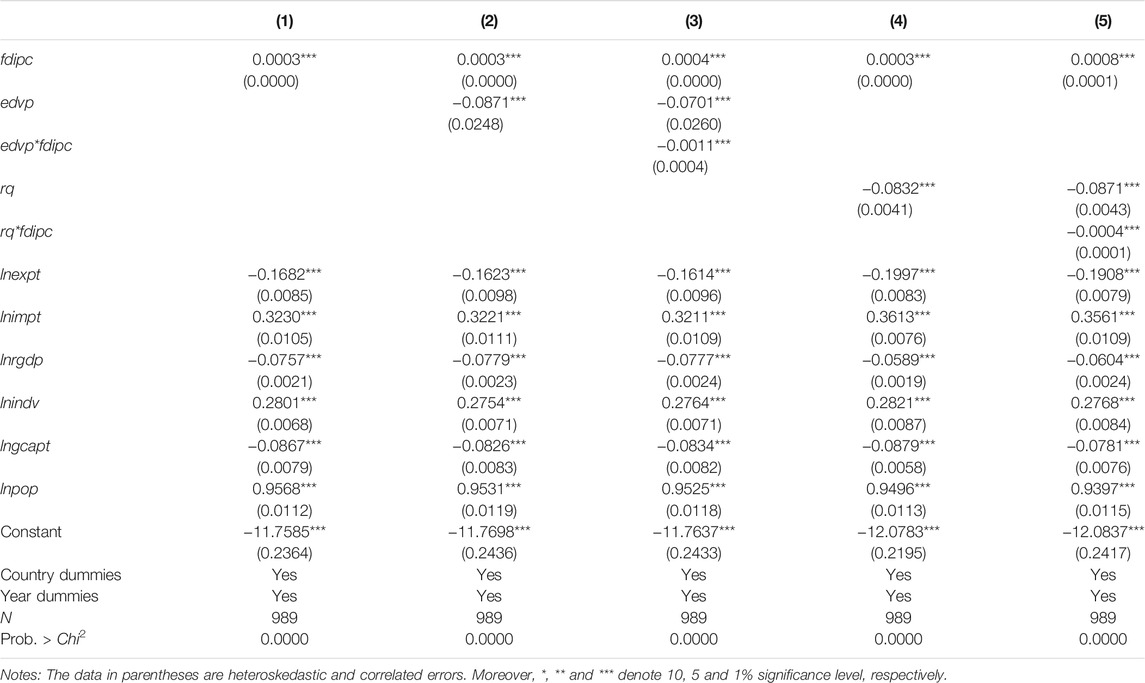

https://doi.org/10.3389/fenrg.2021.820596

The Impacts of FDI Inflows on Carbon Emissions: Economic Development and Regulatory Quality as Moderators Yanyan Huang1 Yanyan Huang1  Fuzhong Chen2* Fuzhong Chen2*  Huini Wei2 Huini Wei2  Jian Xiang2 Jian Xiang2  Zhexiao Xu2 Zhexiao Xu2  Rabia Akram31Institute of Economic Development and Reform, Huaqiao University, Xiamen, China2School of International Trade and Economics, University of International Business and Economics, Beijing, China3School of Business, Guilin University of Electronic Technology, Guilin, China Rabia Akram31Institute of Economic Development and Reform, Huaqiao University, Xiamen, China2School of International Trade and Economics, University of International Business and Economics, Beijing, China3School of Business, Guilin University of Electronic Technology, Guilin, ChinaWith the accelerated development of the global economy, environmental issues have gradually become prominent, which in turn hinders further high-quality economic development. As one of the important driving factors, cross-border flowing foreign direct investment (FDI) has played a vital role in promoting economic development, but has also caused environmental degradation in most host countries. Utilizing panel data for the G20 economies from 1996 to 2018, the purpose of this study is to investigate the impacts of FDI inflows on carbon emissions, and further explore the influence channels through the moderating effects of economic development and regulatory quality. To produce more robust and accurate results in this study, the approach of the feasible generalized least squares (FGLS) is utilized. Meanwhile, this study also specifies the heteroscedasticity and correlated errors due to the large differences and serial correlations among the G20 economies. The results indicate that FDI inflows are positively associated with carbon emissions, as well as both economic development and regulatory quality negatively contribute to the impacts of FDI inflows on carbon emissions. It implies that although FDI inflows tend to increase the emissions of carbon dioxide, they are more likely to mitigate carbon emissions in countries with higher levels of economic development and regulatory quality. Therefore, the findings are informative for policymakers to formulate effective policies to help mitigate carbon emissions and eliminate environmental degradation. IntroductionIn recent decades, the development of the world economy has been facing a relatively serious issue, that is, climate change caused by carbon emissions. A large number of international organizations have made significant efforts to address it. In 1992, the United Nations Conference on Environment and Development signed the United Nations Framework Convention on Climate Change (UNFCCC) to decrease the concentration of greenhouse gases in the atmosphere. In 1997, under the UNFCCC framework, the Kyoto Protocol was signed, and is considered a law to stabilize the amount of greenhouse gases in the atmosphere. Among the six greenhouse gases (GHG) that cause climate change, carbon emissions have the largest impact, accounting for 80% of the total emissions (Ahmad and Wyckoff, 2003). The link between global temperatures and greenhouse gas concentrations, especially carbon dioxide, has been true throughout Earth’s history (Lacis et al., 2010). Therefore, reducing carbon emissions has become an effective way to deal with climate change. According to data from the World in Data based on the Global Carbon Project, before the mid-20th century, the growth of carbon emissions was relatively slow. In 1950, the world emitted just over 5 billion tones of carbon—about the level of the US, or half of China’s annual emissions today (Aller et al., 2020). By 1990, the figure for carbon emissions had quadrupled to 22 billion tonnes. Carbon emissions have continued to grow rapidly, and the world now emits more than 36 billion tonnes a year. Moreover, along with the substantial increase in the world’s total carbon emissions, there is a notable change. In the first half of the 20th Century, global carbon emissions were dominated by Europe and the United States, accounting for over 90% in 1900 and even more than 85% of emissions by 1950 each year. However, in the second half of the 20th century, the main share of the world’s total carbon emissions came from other regions of the world, especially Asia as a whole, of which China accounted for the highest carbon emissions. Meanwhile, the current carbon emissions in the United States and Europe are slightly less than one-third of the total global emissions. In view of this increasingly serious problem, it is generally recognized that to alleviate the serious impact of climate change, countries around the world urgently need to identify the potential drivers of carbon emissions and take effective countermeasures. With the acceleration of economic globalization, the flow of international capital has become more frequent, especially foreign direct investment (FDI), which not only promotes the economic growth of host countries but also brings about a rapid increase in carbon emissions. As one of the most important international investment activities, inflowing FDI has played a vital role in economic and environmental development, which has always been a hot topic in previous studies. The increase in FDI inflows may be associated with global climate change. Hence, many prior studies have paid attention to investigating the impacts of FDI inflows on carbon emissions. However, many existing studies have claimed conflicting links between FDI inflows and environmental contamination. On the one hand, as the Pollution Haven Hypothesis suggests, FDI inflows may exacerbate environmental degradation. The hypothesis states that companies in pollution-intensive industries are most likely based in countries or regions with relatively low environmental standards, which may lead to excessive or suboptimal levels of pollution. Several studies provide evidence to support the pollution-haven effect and find that FDI inflows aggravate carbon emissions (Cole, 2004; Cole et al., 2011; Kheder and Zugravu, 2012; Rahman et al., 2019). On the other hand, FDI inflows can benefit their host countries by transferring innovative technologies, promoting financial development, and improving management (Nair-Reichert and Weinhold, 2001; Bose and Kohli, 2018), which allow companies to adopt environmentally friendly products and technologies that help mitigate carbon emissions and enhance environmental quality (Wheeler, 2001; Zeng and Eastin, 2012; Ahmad et al., 2019). Thus, the pollution halo effect is demonstrated. Additionally, several studies indicate a nonlinear relationship between FDI inflows and carbon emissions (Shahbaz et al., 2015; Alshubiri and Elheddad, 2019). FDI inflows may enhance carbon emissions initially, but after a threshold point, the increase in FDI inflows will bring about a decrease in carbon emissions. Nevertheless, FDI inflows do not independently affect carbon emissions. There are other determinants of carbon emissions such as economic development and regulatory quality. Firstly, a great body of literature has examined the relationship between economic development and pollution emissions. While empirical testing of the Environmental Kuznets Curve (EKC) hypothesis continues to increase, generally pointing out an inverted U-shaped nexus between income and environmental pollution (Dutt, 2009; Apergis, 2016), a portion of researchers have questioned the validity of this theory (Aslanidis and Iranzo, 2009; Al-Mulali et al., 2015; Özokcu and Özdemir, 2017). Secondly, economies with higher regulatory quality are more likely to have stricter environmental policies and follow the regulations of related international environmental agreements. Moreover, these economies prefer to force the firms to comply with the control procedures of pollution emissions (Welsch, 2004). By contrast, under economies with weaker regulatory quality, environmental policies are less likely to be stringent for firms (Damania et al., 2003), and governments potentially make sub-optimal decisions concerning pollution emissions. Consequently, the actual carbon emissions are higher than the optimal levels for any income level. The association between FDI inflows and carbon emissions is a matter of controversy in the literature. The same is true of the indirect effects from economic development and regulator quality on carbon emissions. A variety of studies have focused on the direct association between FDI inflows and carbon emissions, but there may also be indirect effects of FDI inflows on carbon emissions. Therefore, this study introduces economic development and regulatory quality as moderators in investigating the influence mechanism of FDI inflows on carbon emissions. Depending on the literature that has been surveyed in this field, this study expects the moderating effects of economic development and regulatory quality in the association between FDI inflows and carbon emissions. This study is well-positioned to inform policymakers to formulate effective policies to help mitigate carbon emissions. Using panel data of the G20 economies from 1996 to 2018, the purpose of this study is to examine the impacts of FDI inflows on carbon emissions, and the moderating effects of economic development and regulatory quality are investigated. The rest of this study is structured as follows. Literature Review highlights the conceptual framework and reviews related literature. Methodology and Data presents the hypotheses and methodology and statistically describes the data. Empirical Results discusses empirical results. Further Discussions examine the moderating effects of economic development and regulatory quality in carbon emissions. Conclusions and Implications summarize and put forward policy recommendations. Literature ReviewPrevious Research on the FDI Inflows and Carbon EmissionsOver the past decade, there has been an increasing amount of literature on the roles of FDI inflows in carbon emissions. However, the impacts of FDI inflows on carbon emissions have long been a matter of debate. Recent research results on this topic mainly incorporate the following three categories. Firstly, several previous studies have examined the direct impacts of FDI inflows on carbon emissions and put forward the pollution haven hypothesis, which suggests that FDI inflows are associated with a higher level of carbon emissions. On the one hand, to maximize profits, developed countries tend to invest in developing countries with less stringent environmental regulations or lower environmental taxes, which leads to the transfer of polluting industries to these regions (Aller et al., 2020). As a result, carbon emissions in host countries increase with the expansion of FDI-led economic activities (Grimes and Kentor, 2003; Mahadevan and Sun, 2020). By using data from 66 developing countries, Grimes and Kentor (2003) suggested that FDI inflows significantly accelerate the growth of carbon emissions in less developed countries. On the other hand, less developed countries are more inclined to adopt lax regimes to attract foreign investments to achieve economic development (Bommer, 1995). Cole et al. (2006) used data from 33 countries to examine the nexus between FDI inflows and the stringency of environmental policies. The results showed that in countries with high levels of corruption, local carbon emissions increase as multinationals may lobby local governments for lax environmental policies. Secondly, many prior studies have put forward a contradictory hypothesis—the pollution halo hypothesis, indicating that FDI inflows can bring cleaner and more efficient technologies to the host country which are positive to significantly mitigate carbon emissions (Melane-Lavado et al., 2018; Wang et al., 2021). Zhu et al. (2016) suggested that the impacts of FDI inflows on emissions are negative and become significant at higher quantiles in Indonesia, Malaysia, Philippines, Singapore, and Thailand. Furthermore, Acharyya (2009) argued that FDI inflows have a large beneficial effect on carbon emissions by increasing output in a long run in the case of India. Thirdly, some studies have drawn comprehensive conclusions. Using panel data from 32 OECD countries, Alshubiri and Elheddad (2019) claimed a non-linear relationship between FDI inflows and carbon emissions. At the left end of the inflection point, FDI inflows are positively correlated with carbon emissions, while at the right end of the inflection point, FDI inflows are negatively associated with carbon emissions. Shahbaz et al. (2015) utilized data from 99 countries and empirical results suggested that the impacts of FDI inflows on carbon emissions are heterogeneous due to differences in national income. Moreover, there is an inverted U-shaped association between FDI inflows and carbon emissions in middle-income countries. In high-income countries, however, FDI inflows can mitigate carbon emissions, while in low-income countries, the relationship is the opposite (Shahbaz et al., 2015). Prior Studies on Other Factors Influencing Carbon EmissionsIn addition to FDI inflows, other determinants of carbon emissions have been documented in many previous studies. For instance, quite a few studies explore the relationship between economic development and carbon emissions. In some of them, the EKC hypothesis is widely recognized, claiming an inverted U-shaped association between income and environmental pollution. When a country’s economy is underdeveloped, the country may choose to sacrifice the environment (i.e., increased carbon emissions) to achieve economic growth. But when the country reaches a higher level of income, the cost of environmental governance will decrease, which will make the public pay more attention to environmental quality, and thereby promote the country to choose a more environmentally friendly way (Grossman and Krueger, 1995; Harbaugh et al., 2002; Musah et al., 2021; Ren et al., 2021). Grossman and Krueger (1992) summarized three impacts of economic development on the environment as follows. The first is the scale effect. It indicates that an increase in economic activity without technological innovation is associated with more requirements on natural resources, leading to more waste and carbon emissions. In this case, the boom in economic activity negatively contributes to the environment. The second is the composition effect. It implies that wealth accumulation occurs with shifts in the structure of production institutions. In industrial societies, environmental degradation is exacerbated when the economic structure shifts from rural to urban, but is reversed with the structural shift from energy-intensive industries to technological—and knowledge—based services. The third is the technological effect. Such effect suggests that when nations are rich enough so that they can afford expenses on research and development, new technology will replace the obsolete and ensure environmental quality. Furthermore, several prior studies also provide empirical evidence. Panayotou et al. (2000) examined the relationship between carbon emissions and per capita income by using panel data from 17 developed countries for a period from 1870 to 1994 and time-series data for the United Kingdom and the United States. They claimed that the environmental Kuznets curve always exists regardless of the data type. Moreover, the environmental Kuznets curve still exists after adding variables such as population density and export trade. While the empirical testing of the EKC hypothesis continues, several studies have presented confusing results (Shafik, 1994). For instance, using data from 1960 to 1996 in 100 countries, Azomahou et al. (2005) employed a nonparametric panel approach and revealed that economic development always leads to an increase in carbon emissions in both rich and poor countries. Lee et al. (2009) argued that the environmental Kuznets curve does not apply to all countries. They used the data of 89 countries from 1960 to 2000 to obtain an N-shaped curve for all countries. After grouping all samples for regression, the results indicate that middle-income countries, the United States, and Europe present an inverted U-shape, while high-income countries, low-income countries, Africa, Asia, and Oceania countries do not show an environmental Kuznets curve. Besides, regulatory quality is also considered to be one of the important factors affecting carbon emissions. Perera and Lee (2013) indicated that the improvement of institutional quality has boosted economic activity in low-income countries in Asia, and the increase in economic activity may cause a significant increase in carbon emissions. Moreover, the quality of the regulations determines the strictness of a country’s environmental regulatory system. Ibrahim and Law (2015) argued that countries with loose environmental regulations due to international trade tend to specialize in the production of pollution-intensive products, which will inevitably cause the host country to increase carbon emissions. The poor regulatory quality may also mitigate pollution indirectly through the reduction in income per capita. Welsch (2004), Cole (2007) claimed that the overall effects of regulatory quality captured by corruption levels are insignificant, except for high-income economies, where the total effect of regulatory quality on emissions is found to be negative and significant. On the other hand, the improvement of regulatory quality can improve the allocation of resources, and Porter’s hypothesis believed that strict environmental regulations promote innovation of enterprises, decrease production costs, and eliminate the negative impact on the environment (Herrera-Echeverri et al., 2014; Dong et al., 2021). Therefore, the quality of the regulations has a double-edged sword effect on carbon emissions. There are empirical results that can provide a more comprehensive conclusion. On the one hand, the improvement of regulatory quality effectively promotes the increase of economic activities, which causes an increase in carbon emissions. On the other hand, the improvement of regulatory quality will affect the impact mechanism of FDI inflows on carbon emissions, which significantly mitigates carbon emissions. In addition to these two factors, many others also affect the impacts of FDI inflows on carbon emissions, such as financial development, urbanization, and tourism (Tamazian et al., 2009; Lee and Brahmasrene, 2013; Sadorsky, 2014; Aller et al., 2020; Paramati et al., 2021). Moreover, Salman et al. (2019) employed a panel quantile regression to investigate the effects of imports and exports of seven of the ASEAN countries on carbon emissions, and the results show that imports and exports have a positive effect on carbon emissions, while population size negatively contributes to carbon emissions. Similarly, Dong et al. (2020) examined the effects of GDP on carbon emissions and indicated that the proportion of industrial added value to GDP negatively contributes to carbon emissions. Pao et al. (2011) also investigated the effect of the real output on carbon emissions in Russia and suggested a negative association. Besides, gross fixed capital formation is regarded as an important part of factors that decrease carbon emissions (Mitić et al., 2020). Literature GapDespite the impacts of FDI inflows on carbon emissions that have been documented in an increasing number of studies, certain research gaps remain. Firstly, despite the fact of researchers’ intense focus on the deterioration of environmental quality and significant attention to the impacts of FDI inflows on carbon emissions, the related consequences are inconclusive. Secondly, in addition to the direct impacts, little literature has focused on examining the indirect effects of FDI inflows on carbon emissions, especially investigating the influence channels. Unlike previous research, this study aims to investigate the impacts of FDI inflows on carbon emissions through novel channels with the moderators of economic development and regulator quality. Methodology and DataHypothesesIn recent years, many researchers have focused on the impacts of FDI inflows on carbon emissions, but they have not concluded a consistent insight. Moreover, little research has investigated the influence channels of the impacts of FDI inflows on carbon emissions. Therefore, this study will examine the moderating effects of economic development and regulatory quality in carbon emissions, which may provide a new explanation for the differential impact of FDI inflows on carbon emissions. Figure 1 presents the theoretical framework of this study. FIGURE 1 FIGURE 1. Theoretical framework. Concerning the direct impacts of FDI inflows on carbon emissions, Shahbaz et al. (2019) explored the effects of FDI inflows on carbon emissions in the United States, and the results show that FDI inflows increase carbon emissions. Although the United States is a developed country, FDI inflows have not reduced carbon dioxide emissions as expected by the EKC hypothesis. Similarly, Lau et al. (2014b) reached the same conclusion by using the panel data from Malaysia. Furthermore, Kaya et al. (2017) indicated that FDI inflows are negatively associated with carbon emissions in the short term, but they will promote Turkey’s carbon emissions in the long run. Kivyiro and Arminen (2014) claimed FDI inflows appear to increase carbon emissions in six Sub-Saharan African countries. All these aforementioned studies support the pollution haven hypothesis. In this study, the G20 economies are employed as samples to explore the impacts of FDI inflows on carbon emissions. Furthermore, most economies have a large economic size and a relatively high of level industrial development. Thus, this study puts forward the following hypothesis: Hypothesis 1 (H1). Given economic resources and other control variables, FDI inflows significantly and positively contribute to carbon emissions.According to previous research, the EKC hypothesis is widely recognized, countries with a higher level of economic development pay more attention to environmental protection and improving environmental quality, and hence, richer countries have fewer carbon emissions. However, some studies challenged this hypothesis. Luo et al. (2016) examined the EKC hypothesis for carbon emissions in G20 countries, while the empirical results show that for developing countries, it is in line with the EKC hypothesis, but for developed countries, there is a negative association between economic development and carbon emissions. Besides, Narayan and Narayan (2010) examined the EKC hypothesis for 43 developing countries, and the results reveal that carbon emissions have fallen with economic growth in the long run. Furthermore, Narayan et al. (2016) extended the prior research sample to 118 countries and suggested that in 49 countries, with the national income growth, carbon emissions decline. Concerning the G20 economies, most have a high level of economic development. In this study, a further investigation is conducted to examine the impacts of FDI inflows on carbon emissions moderated by economic development. Thus, the hypothesis is proposed as follows: Hypothesis 2 (H2). Economic development weakens the impacts of FDI inflows on carbon emissions, and that is, the higher level of economic development, the more likely FDI inflows to mitigate carbon emissions.Simultaneously, Lau et al. (2014a) explored the effects of regulatory quality on carbon emissions and claimed that regulatory quality is negatively associated with carbon emissions. Besides, Ali et al. (2019) empirically supported the negative effect of regulatory quality on carbon emissions by using the dynamic panel GMM estimations. Also, other empirical results show approximately consistent conclusions (Wawrzyniak and Doryń, 2020). Moreover, Adedoyin et al. (2019) used balanced panel data over the period 1990–2014 from BRICS countries to investigate the nexus between regulatory quality and carbon emissions, indicating a positive and statistically significant association. Although a hypothesis is developed regarding the enhancing effects of FDI inflows on carbon emissions, this study does not expect that such a moderating effect may occur for carbon emissions. Nevertheless, the quality of regulations may mitigate the effects of FDI inflows on carbon emissions. Hence, this study further investigates the impacts of FDI inflows on carbon emissions moderated by regulatory quality. Thus, this paper proposes the following hypothesis: Hypothesis 3(H3). Regulatory quality negatively contributes to the effects of FDI inflows on carbon emissions, and that is, the higher quality level of regulations, the greater the possibility that FDI inflows decrease carbon emissions. Model SpecificationThe purpose of this study is to investigate the impacts of FDI inflows on carbon emissions. Following the specifications of Chen et al. (2019), Chen et al. (2021b), the baseline model is specified as follows: lnceit=α0+α1fdipcit+∑j=1kβjCVj,it+vi+σt+εit(1)In Eq. 1, lnce represents the dependent variable of carbon emissions, which is measured by the emissions of carbon dioxide. The independent variable of FDI inflows is denoted by fdipc, which is measured by the net inflows of FDI. α0 and α1 are the coefficients of the constant term and FDI inflows, respectively. βj indicates the coefficient of the control variable (CVj), and k is the number of the control variables. To produce more accurate estimates, this study incorporates all country dummies (vi) and year dummies (σt). Additionally, the disturbance term is denoted by εit. Following the specifications of Aller et al. (2020), Ali et al. (2021), the control variables (CV) incorporate the exports of goods and services (lnexpt), imports of goods and services (lnimpt), economic size (lnrgdp), industrial added values (lnindv), gross fixed capital formation (lngcapt), and population (lnpop). To be more specific, the economic size is measured by deflated GDP. Except for FDI inflows, all variables are taken in the natural logarithm forms. In addition to an investigation of the direct impacts of FDI inflows on carbon emissions, this study also further examines the moderating effects of economic development and regulatory quality. Following the approaches of Ehigiamusoe et al. (2020), Zheng et al. (2021), the moderated regressions are specified as follows: lnceit=α0+α1fdipcit+ϕedvpit+θedvpit∗fdipcit+∑j=1kβjCVj,it+vi+σt+εit(2)lnceit=α0+α1fdipcit+δrqit+γrqit∗fdipcit+∑j=1kβjCVj,it+vi+σt+εit(3)In Eq. 2, edvp indicates the economic development, which is measured by the growth rate of GDP per capita. Also, ϕ is the coefficient of economic development. The moderating effects are specified by the interactive term (edvp∗fdipc) of economic development and FDI inflows, and its coefficient is denoted by θ. In Eq. 3, this study also constructs an interactive term (rq∗fdipc) of regulatory quality (rq) and FDI inflows, whose coefficient is represented by γ. Moreover, δ stands for the coefficient of regulatory quality. In terms of H2 and H3, the signs of the coefficients specific to θ and γ are expected to be statistically negative, suggesting that economic development and regulatory quality mitigate the impacts of FDI inflows on carbon emissions. Data DescriptionThe panel data is collected from the World Development Indicators (WDI) and Worldwide Governance Indicators (WGI), both of the data of WDI and WGI come from the World Bank Database. In detail, the data of FDI inflows and related control variables are from WDI, and that of regulatory quality are from the WGI, respectively. To make the sample more representative, the economies of the G20 are incorporated in this study. In terms of the statistics from the World Bank, the GDP of the G20 economies accounts for more than 85% of the world’s total economy, and its population exceeds two-thirds of the world’s total population (See Figure 2). Hence, the panel data utilized in this study are strongly balanced. FIGURE 2 FIGURE 2. The changing trends of FDI and GDP in G20 economies from 1996 to 2018. To make the economies comparable, this study also includes EU member countries in the sample like other non-EU member economies. Specifically, the sample consists of 27 EU countries and 16 non-EU countries. Accordingly, France, Germany, and Italy are both EU and G20 members. Therefore, there are 43 sample countries. Moreover, the research data is from 1996 to 2018, since most of the variables used in this study have substantial missing values in 2019 and 2020. Concerning the variable of regulatory quality, the data in 1997, 1999, and 2001 are missing, which are imputed using the mean of the data in 1996 and 1998, the mean of the data in 1998 and 2000, and the mean of the data in 2000 and 2002, respectively. Moreover, the missing values of related variables in specific, such as Mexico and Canada, are filled in with the mean of the data of two consecutive years. Thus, the sample size is 989, and the panel data used in this study are balanced with 43 countries (N) and 23 years (T). Table 1 presents the results of the statistical description. For the dependent variable of carbon emissions, the mean value is 11.7969, and the minimum and maximum values are 7.2079 and 16.1490, respectively. Simultaneously, the standard deviations of carbon emissions overall and between economies are 1.7587 and 1.7712, respectively. This implies that the differentials of carbon emissions between the G20 economies are even larger than that of all the sampling countries. Concerning the independent variable of FDI inflows, the mean, minimum and maximum values are 7.0310, −47.5108, and 366.8067, respectively. Moreover, the standard deviation is as high as 25.7191, indicating significant differences in FDI inflows among the G20 economies. Hence, it is necessary to consider the heteroscedasticity of the dependent and independent variables. TABLE 1 TABLE 1. Descriptive statistics of panel data. For the control variables, exports of goods and services range from 21.6049 to 28.6094 with a standard deviation of 1.4883, and the minimum and maximum values of imports of goods and services are 21.8062 and 28.7752 with a standard deviation of 1.4542. This implies that the trade between the G20 economies is frequent, and the gap between their exports is relatively large, as is the case for imports. The control variable of economic size is measured by real GDP. Its mean value is 17.4004 with minimum and maximum values of 13.1425 and 21.3932, which shows the huge gap in economic scale between the G20 economies. The standard deviation of industrial added values is 1.8508, and its minimum and maximum values are 20.6929 and 29.3376, respectively. The standard deviation of the gross fixed capital formation and population are 1.8130 and 1.8448, suggesting significant differences in the G20 economies. For the moderating variables, the average growth rate of GDP per capita is 2.51%, and minimum and maximum values are −14.35 and 24.00%. Additionally, the mean value of regulatory quality is 0.9062 with a standard deviation of 0.6961. Therefore, regardless of the control variables and moderating variables of the G20 economies, there are significant differences among countries, which means that the heteroscedasticity needs to be considered as well. Empirical ResultsResults of Baseline EstimationsUtilizing the panel data over the period of 1996–2018 for the G20 economies, this study aims to investigate the impacts of FDI inflows on carbon emissions as well as the moderating effects of economic development and regulatory quality. To produce more robust estimates, whether to utilize the regressions of the pooled ordinary least squares (POLS), random-effect (RE), and fixed-effect (FE) are verified in detail. For the selection of estimation approaches of the POLS and FE regression, an F test specific to all the intercept terms is employed. The result displays that F (42, 939) = 229.4500, and thereby rejects the null hypothesis at a significance of 1%. Hence, compared with the POLS regression, FE regression is more appropriate in this study. Simultaneously, concerning the selection of regression methods of the FE and RE regression, a Hausman test is utilized, and the result suggests that Chi2 (6) = 40.3300 with a p-value of 0.0000, indicating that the RE regression is inadequate in this study. Thus, this study utilizes the approach of the FE regression to evaluate the impacts of FDI inflows on carbon emissions. Furthermore, the serial correlation of the panel data in this study is checked by using the Wooldridge test. The result shows that F (1, 42) = 103.1460, and the null hypothesis of no first-order autocorrelation is statistically rejected at a significance of 1%. In addition to the heteroscedasticity, the heteroskedastic and correlated errors need to be specified. Additionally, to produce more accurate estimation results, the approach of the feasible generalized least squares (FGLS) is utilized in all estimates. Table 2 displays the results of baseline estimations. In Columns (1) and (2), all control variables are entered. Due to significant differences among the G20 economies, the country dummies are added in all estimates. In Columns (1) and (3), the year dummies are excluded. To eliminate the estimation bias, this study includes year dummies in subsequent estimates. According to the estimation results, the coefficients of the exports of goods and services (lnexpt) are significantly negative, which implies that the more a country exports, the less carbon it emits. In terms of Melitz (2003), only countries with higher technological levels and productivity can be more competitive in the international trade market and can export more goods. The results show a statistically positive association between the imports of goods and services (lnimpt) and carbon emissions, which is consistent with Ali et al. (2021). Moreover, the results display that the real GDP (lnrgdp) and gross fixed capital formation (lngcapt) are positive to decrease carbon emissions. Although there are some developing countries in the G20 economies, most of them have a high level of income. The larger the economic size of a country as well as the more fixed capital investment, the more it can improve production technology and environmental regulations, and thereby mitigate carbon emissions, which is as expected in the EKC hypothesis (Aller et al., 2020). Similar to the impacts of exports on carbon emissions, the results also indicate a significantly positive nexus of industrial added value (lnindv) and population (lnpop) specific to carbon emissions. The provision of industrial products requires more energy consumption, which in turn needs to emit more carbon. Similarly, the larger the population, the more energy is consumed, and thereby the more carbon dioxide is produced, which is consistent with Chen et al. (2021a). TABLE 2 TABLE 2. Results of regressions on carbon emissions. In Columns (3) and (4) of Table 2, the independent variable of FDI inflows (fdipc) is incorporated. In terms of the estimation results, the coefficients of FDI inflows are significant and positive, indicating that FDI inflows contribute to the increase of carbon emissions. FDI inflows have attracted international investment from multinational companies and big polluting companies, and it also increases carbon emissions (Acharyya, 2009). Concerning most G20 economies, they have a large population and complete infrastructure, which can provide sufficient labor and a mature investment environment for FDI inflows. Compared with countries with small economies, the G20 economies have created more than 85% of the world’s GDP and also emit a large amount of carbon dioxide. Simultaneously, in terms of statistics from the World Bank, FDI flowing into the G20 economies accounted for more than 60% in 2019. Thus, the results are as hypothesized in H1. Robustness CheckTo produce more robust and unbiased estimation results, a comprehensive robustness check is performed. Firstly, the alternative regression approach of the least squares dummy variable (LSDV) is utilized. The second method is to re-estimate the model with samples of higher than average GDP per capita. Since the approach of the FGLS is only available for the balanced panel data, this study employs the method of the panel data with the FE regression. Thirdly, this study re-estimates the model with sampling countries from the EU. In Columns (1) to (3) of Table 3, the results of the first three methods to check the estimation robustness are presented, respectively. The results indicate that the coefficients of FDI inflows remain statistically positive, and most of the control variables are also as expected. TABLE 3 TABLE 3. Results of robustness check. Additionally, this study utilizes the approach of the dynamic generalized method of moments (GMM) estimation to eliminate the estimation bias caused by the endogeneity between FDI inflows and carbon emissions. This study enters the first- and second-order lag terms of the dependent variable of FDI inflows in Column (4). To verify whether the GMM estimator is consistent, the Arellano–Bond test is utilized, and the null hypothesis is that there is no second-order autocorrelation of the disturbance term. The results indicate that the statistic z = −1.1700 and the p-value is 0.2430, which means that the null hypothesis can not be statistically rejected. Thus, the GMM estimator used in this study is consistent. Moreover, this study also conducts a Sargan test to verify whether there are excessive instrumental variables. The null hypothesis of the Sargan test is that the instrumental variables are appropriate. The results reveal that the Chi2 (808) = 847.2000, and the p-value is 0.1640, which implies that the null hypothesis can not be rejected. Furthermore, the difference GMM is utilized in this study, and the results are reported in Column (4) of Table 3. The results show that FDI inflows still make a positive contribution to carbon emissions, and the signs of most control variables remain unchanged. Therefore, the results of the robustness check are still consistent with H1. Further DiscussionsTo examine the influence channels of FDI inflows on carbon emissions, this study firstly investigates the moderating effect of economic development. Columns (1) to (3) of Table 4 present the moderated regression results of economic development. The results indicate that all the three coefficients of FDI inflows are positive at a significance of 1%. In Column (2), the variable of economic development (edvp) is incorporated. The results show that the higher level of economic development, the lower the carbon emissions. The results are consistent with the EKC hypothesis. In addition to the specification of Column (2), this study incorporates the interactive term of economic development and FDI inflows (edvp*fdipc) in Column (3). The results suggest that the coefficient of the interactive term is significantly negative, which implies that economic development mitigates the impacts of FDI inflows on carbon emissions. In terms of the EKC hypothesis, there is an inverted U-shaped association between income and environmental pollution, as is the case for economic development and carbon emissions. If a country reaches a high economic development level, it will pay more attention to sustainable and green development, and thereby introducing environmentally friendly FDI and decreasing carbon emissions. Thus, the results are as hypothesized in H2. TABLE 4 TABLE 4. Results of moderating effects from economic development and regulatory quality. To further investigate the moderating effects of regulatory quality specific to the impacts of FDI inflows on carbon emissions, this study constructs an interactive term of regulatory quality and FDI inflows (rq*fdipc), which is entered in Column (5) of Table 4. Meanwhile, the variable f regulatory quality (rq) is included in Columns (4) and (5). The results show that the coefficients of FDI inflows are positive, with a significance of 1%. The results are consistent with those of Hassan et al. (2021), in which regulatory quality with lower political risk is considered to be positive to mitigate carbon emissions. As mentioned in H3, regulatory quality is statistically and negatively associated with carbon emissions. Furthermore, the coefficient of the interactive term in Column (5) is significantly negative, which reveals that a higher quality level of regulations, the greater the possibility that FDI inflows decrease carbon emissions. With the improvement of regulatory quality, more attention has been paid to reducing the negative impact on the environment when introducing FDI, and thereby reducing carbon emissions. Thus, H3 is well verified. Conclusion and ImplicationsWith the rapid development of the world economy, the issue of climate change has become the limitation of further sustainable economic growth. Economic globalization has promoted the cross-border flows of international capital, and FDI inflows have played a vital role in the economic activities of various countries, as well as carbon emissions. With the promotion of sustainable development strategies, increasingly more countries are beginning to pay attention to environmental protection, especially developed countries who are active to construct the friendly nexus between economic development and environmental sustainability. In this context, many economies have formulated a series of measures to regulate FDI activities, reduce pollutant emissions, and thereby achieve the goal of environmental protection. In this study, panel data of the G20 economies from 1996 to 2018 are utilized to investigate the direct impacts of FDI inflows on carbon emissions. Simultaneously, the influence channels that the moderating effects of economic development and regulatory quality are explored. To produce more robust and accurate estimates, this study performs regressions by utilizing the approach of the FGLS and specifies the heteroskedastic and correlated errors. The results indicate that FDI inflows positively contribute to carbon emissions, which implies that with the increasing inflows of FDI, the G20 economies emit more carbon dioxide. Concerning the influence channels, the results suggest that both economic development and regulatory quality mitigate the impacts of FDI inflows on carbon emissions. It implies that with a higher development level of the G20 economies, FDI inflows are more likely to decrease carbon emissions. Simultaneously, with a higher quality level of regulations in the G20 economies, the inflows of FDI positively decrease carbon emissions. The findings of this study identify vital policy implications in enhancing FDI inflows, accelerating economic development, and improving regulatory quality to decrease carbon emissions and further eliminate environmental degradation. Meanwhile, the policy recommendations of this study also have important insights on the emission of pollutants other than carbon dioxide. First, countries are recommended to develop a sustainable economy. Although FDI inflows have been demonstrated to be positive to economic growth, they may degrade the environment, thereby reducing the quality of economic development. In this study, FDI inflows are positively associated with carbon emissions. However, for the high development level of the G20 economies, FDI inflows, in turn, decrease their carbon emissions. Therefore, it is crucial for a country to pay more attention to the quality of economic development, which helps mitigate carbon emissions caused by inflows of FDI. Second, policymakers are encouraged to formulate effective measures to improve the quality of regulations specific to pollution emissions. In light of the empirical results, although FDI inflows are positive to increase carbon emissions, regulatory quality negatively mitigates the impacts of FDI inflows on carbon emissions. Hence, it is crucial for a country to enhance environmental regulations when introducing FDI to develop its economy. Data Availability StatementPublicly available datasets were analyzed in this study. This data can be found here: https://www.worldbank.org. Author ContributionsYH contributed to conceptualization. YH and FC contributed to data curation and writing. HW contributed to formal analysis. YH and FC contributed to funding acquisition. JX contributed to methodology. ZX and RA contributed to proofreading and editing. All authors contributed to the article and approved the submitted version. FundingThe authors acknowledge the financial support of Huaqiao University’s Academic Project Supported by the Fundamental Research Funds for the Central Universities (20SKGC-QT01). Conflict of InterestThe authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest. Publisher’s NoteAll claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher. ReferencesAcharyya, J. (2009). FDI, Growth and the Environment: Evidence from India on CO2 Emission during the Last Two Decades. J. Econ. Dev. 34 (1), 43–58. doi:10.35866/caujed.2009.34.1.003 CrossRef Full Text | Google Scholar Adedoyin, F. F., Gumede, M. I., Bekun, F. V., Etokakpan, M. U., and Balsalobre-Lorente, D. (2019). Modelling Coal Rent, Economic Growth and CO2 Emissions: Does Regulatory Quality Matter in BRICS Economies? Sci. Total Environ. 710, 136284. doi:10.1016/j.scitotenv.2019.136284 PubMed Abstract | CrossRef Full Text | Google Scholar Ahmad, M., Ul Haq, Z., Khan, Z., Khattak, S. I., Ur Rahman, Z., and Khan, S. (2019). Does the Inflow of Remittances Cause Environmental Degradation? Empirical Evidence from China. Econ. Research-Ekonomska Istraživanja 32 (1), 2099–2121. doi:10.1080/1331677X.2019.1642783 CrossRef Full Text | Google Scholar Ahmad, N., and Wyckoff, A. (2003). Carbon Dioxide Emissions Embodied in International Trade of Goods. OECD Sci. Tech. Industry Working Pap. 25 (4), 1–22. doi:10.1787/18151965 CrossRef Full Text | Google Scholar Al-Mulali, U., Ozturk, I., and Lean, H. H. (2015). The Influence of Economic Growth, Urbanization, Trade Openness, Financial Development, and Renewable Energy on Pollution in Europe. Nat. Hazards 79 (1), 621–644. doi:10.1007/s11069-015-1865-9 CrossRef Full Text | Google Scholar Ali, H. S., Zeqiraj, V., Lin, W. L., Law, S. H., Yusop, Z., Bare, U. A. A., et al. (2019). Does Quality Institutions Promote Environmental Quality? Environ. Sci. Pollut. Res. 26, 10446–10456. doi:10.1007/s11356-019-04670-9 CrossRef Full Text | Google Scholar Ali, S., Dogan, E., Chen, F., and Khan, Z. (2021). International Trade and Environmental Performance in Top Ten‐emitters Countries: The Role of Eco‐innovation and Renewable Energy Consumption. Sust. Dev. 29 (2), 378–387. doi:10.1002/sd.2153 CrossRef Full Text | Google Scholar Aller, C., Ductor, L., and Grechyna, D. (2021). Robust Determinants of CO2 Emissions. Energ. Econ. 96, 105154. doi:10.1016/j.eneco.2021.105154 CrossRef Full Text | Google Scholar Alshubiri, F., and Elheddad, M. (2019). Foreign Finance, Economic Growth and CO2 Emissions Nexus in OECD Countries. Ijccsm 12 (2), 161–181. doi:10.1108/IJCCSM-12-2018-0082 CrossRef Full Text | Google Scholar Apergis, N. (2016). Environmental Kuznets Curves: New Evidence on Both Panel and Country-Level CO2 Emissions. Energ. Econ. 54 (2), 263–271. doi:10.1016/j.eneco.2015.12.007 CrossRef Full Text | Google Scholar Aslanidis, N., and Iranzo, S. (2009). Environment and Development: Is There a Kuznets Curve for CO2emissions? Appl. Econ. 41 (6), 803–810. doi:10.1080/00036840601018994 CrossRef Full Text | Google Scholar Azomahou, T., Laisney, F., and Nguyen Van, P. (2006). Economic Development and CO2 Emissions: A Nonparametric Panel Approach. J. Public Econ. 90 (6), 1347–1363. doi:10.1016/j.jpubeco.2005.09.005 CrossRef Full Text | Google Scholar Ben Kheder, S., and Zugravu, N. (2012). Environmental Regulation and French Firms Location Abroad: An Economic Geography Model in an International Comparative Study. Ecol. Econ. 77, 48–61. doi:10.1016/j.ecolecon.2011.10.005 CrossRef Full Text | Google Scholar Bommer, R. (1999). Environmental Policy and Industrial Competitiveness: The Pollution-Haven Hypothesis Reconsidered. Rev. Int. Econ. 7 (2), 342–355. doi:10.1111/1467-9396.00168 CrossRef Full Text | Google Scholar Bose, S., and Kohli, B. (2018). Study of FDI Trends and Patterns in BRICS Economies during the Period 1990-2015. Emerging Economy Stud. 4 (1), 78–101. doi:10.1177/2394901518769225 CrossRef Full Text | Google Scholar Chen, F., Hussain, M., Khan, J. A., Mir, G. M., and Khan, Z. (2021a). Voluntary Disclosure of Greenhouse Gas Emissions by Cities under Carbon Disclosure Project: A Sustainable Development Approach. Sust. Dev. 29 (4), 719–727. doi:10.1002/sd.2169 CrossRef Full Text | Google Scholar Chen, F., Jiang, G., and Kitila, G. M. (2021b). Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries. Sustainability 13 (4), 1958. doi:10.3390/su13041958 CrossRef Full Text | Google Scholar Chen, F., Jiang, G., and Wang, W. (2019). Institutional Quality and its Impact on the Facilitation of Foreign Direct Investment: Empirical Evidence from the Belt and Road Countries. Jcefts 12 (3), 167–188. doi:10.1108/JCEFTS-07-2019-0041 CrossRef Full Text | Google Scholar Cole, M. A. (2007). Corruption, Income and the Environment: An Empirical Analysis. Ecol. Econ. 62 (3), 637–647. doi:10.1016/j.ecolecon.2006.08.003 CrossRef Full Text | Google Scholar Cole, M. A., Elliott, R. J. R., and Fredriksson, P. G. (2006). Endogenous Pollution Havens: Does FDI Influence Environmental Regulations? Scand. J. Econ. 108, 157–178. doi:10.1111/j.1467-9442.2006.00439.x CrossRef Full Text | Google Scholar Cole, M. A., Elliott, R. J. R., and Zhang, J. (2011). Growth, Foreign Direct Investment, and the Environment: Evidence from Chinese Cities. J. Reginal Sci. 51 (1), 121–138. doi:10.1111/j.1467-9787.2010.00674.x CrossRef Full Text | Google Scholar Cole, M. A. (2004). Trade, the Pollution haven Hypothesis and the Environmental Kuznets Curve: Examining the Linkages. Ecol. Econ. 48 (1), 71–81. doi:10.1016/j.ecolecon.2003.09.007 CrossRef Full Text | Google Scholar Damania, R., Fredriksson, P. G., and List, J. A. (2003). Trade Liberalization, Corruption, and Environmental Policy Formation: Theory and Evidence. J. Environ. Econ. Manag. 46 (3), 490–512. doi:10.1016/S0095-0696(03)00025-1 CrossRef Full Text | Google Scholar Dong, B., Ma, X., Zhang, Z., Zhang, H., Chen, R., Song, Y., et al. (2020). Carbon Emissions, the Industrial Structure and Economic Growth: Evidence from Heterogeneous Industries in China. Environ. Pollut. 262, 114322. doi:10.1016/j.envpol.2020.114322 PubMed Abstract | CrossRef Full Text | Google Scholar Dong, K., Ren, X., and Zhao, J. (2021). How Does Low-Carbon Energy Transition Alleviate Energy Poverty in China? A Nonparametric Panel Causality Analysis. Energ. Econ. 103, 105620. doi:10.1016/j.eneco.2021.105620 CrossRef Full Text | Google Scholar Dutt, K. (2009). Governance, Institutions and the Environment-Income Relationship: A Cross-Country Study. Environ. Dev. Sustain. 11 (4), 705–723. doi:10.1007/s10668-007-9138-8 CrossRef Full Text | Google Scholar Ehigiamusoe, K. U., Lean, H. H., and Smyth, R. (2020). The Moderating Role of Energy Consumption in the Carbon Emissions-Income Nexus in Middle-Income Countries. Appl. Energ. 261, 114215. doi:10.1016/j.apenergy.2019.114215 CrossRef Full Text | Google Scholar Grimes, P., and Kentor, J. (2003). Exporting the Greenhouse: Foreign Capital Penetration and CO2 Emissions 1980–1996. Jwsr 9 (2), 261–275. doi:10.5195/jwsr.2003.244 CrossRef Full Text | Google Scholar Grossman, G., and Krueger, A. (1992). Environmental Impacts of a North American Free Trade Agreement. NBER Working Paper No. 3914. Cambridge: National Bureau Of Economic Research. doi:10.3386/w3914 CrossRef Full Text | Google Scholar Grossman, G. M., and Krueger, A. B. (1995). Economic Growth and the Environment. Q. J. Econ. 110 (2), 353–377. doi:10.2307/2118443 CrossRef Full Text | Google Scholar Harbaugh, W. T., Levinson, A., and Wilson, D. M. (2002). Reexamining the Empirical Evidence for an Environmental Kuznets Curve. Rev. Econ. Stat. 84 (3), 541–551. doi:10.1162/003465302320259538 CrossRef Full Text | Google Scholar Hassan, T., Song, H., and Kirikkaleli, D. (2021). International Trade and Consumption-Based Carbon Emissions: Evaluating the Role of Composite Risk for RCEP Economies. Environ. Sci. Pollut. Res., 1–13. doi:10.1007/s11356-021-15617-4 CrossRef Full Text | Google Scholar Herrera-Echeverri, H., Haar, J., and Estévez-Bretón, J. B. (2014). Foreign Direct Investment, Institutional Quality, Economic freedom and Entrepreneurship in Emerging Markets. J. Business Res. 67 (9), 1921–1932. doi:10.1016/j.jbusres.2013.11.020 CrossRef Full Text | Google Scholar Ibrahim, M. H., and Law, S. H. (2015). Institutional Quality and CO2Emission-Trade Relations: Evidence from Sub-saharan Africa. South Afr. J. Econ. 84 (2), 323–340. doi:10.1111/saje.12095 CrossRef Full Text | Google Scholar Kaya, G., Özgür Kayalica, M., Kumaş, M., and Ulengin, B. (2017). The Role of Foreign Direct Investment and Trade on Carbon Emissions in Turkey. Environ. Econ. 8 (1), 8–17. doi:10.21511/ee.08(1).2017.01 CrossRef Full Text | Google Scholar Kivyiro, P., and Arminen, H. (2014). Carbon Dioxide Emissions, Energy Consumption, Economic Growth, and Foreign Direct Investment: Causality Analysis for Sub-saharan Africa. Energy 74, 595–606. doi:10.1016/j.energy.2014.07.025 CrossRef Full Text | Google Scholar Lacis, A. A., Schmidt, G. A., Rind, D., and Ruedy, R. A. (2010). Atmospheric CO2: Principal Control Knob Governing Earth's Temperature. Science 330 (6002), 356–359. doi:10.1126/science.1190653 PubMed Abstract | CrossRef Full Text | Google Scholar Lau, L.-S., Choong, C.-K., and Eng, Y.-K. (2014a). Carbon Dioxide Emission, Institutional Quality, and Economic Growth: Empirical Evidence in Malaysia. Renew. Energ. 68, 276–281. doi:10.1016/j.renene.2014.02.013 CrossRef Full Text | Google Scholar Lau, L.-S., Choong, C.-K., and Eng, Y.-K. (2014b). Investigation of the Environmental Kuznets Curve for Carbon Emissions in Malaysia: Do Foreign Direct Investment and Trade Matter? Energy Policy 68, 490–497. doi:10.1016/j.enpol.2014.01.002 CrossRef Full Text | Google Scholar Lee, C.-C., Chiu, Y.-B., and Sun, C.-H. (2009). Does One Size Fit All? A Reexamination of the Environmental Kuznets Curve Using the Dynamic Panel Data Approach. Rev. Agr Econ. 31 (4), 751–778. doi:10.1111/j.1467-9353.2009.01465.x CrossRef Full Text | Google Scholar Lee, J. W., and Brahmasrene, T. (2013). Investigating the Influence of Tourism on Economic Growth and Carbon Emissions: Evidence from Panel Analysis of the European Union. Tourism Manag. 38, 69–76. doi:10.1016/j.tourman.2013.02.016 CrossRef Full Text | Google Scholar Luo, G., Weng, J.-H., Zhang, Q., and Hao, Y. (2016). A Reexamination of the Existence of Environmental Kuznets Curve for CO2 Emissions: Evidence from G20 Countries. Nat. Hazards 85, 1023–1042. doi:10.1007/s11069-016-2618-0 CrossRef Full Text | Google Scholar Mahadevan, R., and Sun, Y. (2020). Effects of Foreign Direct Investment on Carbon Emissions: Evidence from China and its Belt and Road Countries. J. Environ. Manage. 276, 111321. doi:10.1016/j.jenvman.2020.111321 PubMed Abstract | CrossRef Full Text | Google Scholar Melane-Lavado, A., Álvarez-Herranz, A., and González-González, I. (2018). Foreign Direct Investment as a Way to Guide the Innovative Process towards Sustainability. J. Clean. Prod. 172, 3578–3590. doi:10.1016/j.jclepro.2017.03.131 CrossRef Full Text | Google Scholar Melitz, M. J. (2003). The Impact of Trade on Intra-industry Reallocations and Aggregate Industry Productivity. Econometrica 71 (6), 1695–1725. doi:10.1111/1468-0262.00467 CrossRef Full Text | Google Scholar Mitić, P., Kostić, A., Petrović, E., and Cvetanovic, S. (2020). The Relationship between CO2 Emissions, Industry, Services and Gross Fixed Capital Formation in the Balkan Countries. Ee 31 (4), 425–436. doi:10.5755/j01.ee.31.4.24833 CrossRef Full Text | Google Scholar Musah, M., Kong, Y., and Vo, X. V. (2021). Predictors of Carbon Emissions: An Empirical Evidence from NAFTA Countries. Environ. Sci. Pollut. Res. 28, 11205–11223. doi:10.1007/s11356-020-11197-x CrossRef Full Text | Google Scholar Nair-Reichert, U., and Weinhold, D. (2001). Causality Tests for Cross-Country Panels: A New Look at FDI and Economic Growth in Developing Countries. Oxford Bull. Econ. Stat. 63 (2), 153–171. doi:10.1111/1468-0084.00214 CrossRef Full Text | Google Scholar Narayan, P. K., and Narayan, S. (2010). Carbon Dioxide Emissions and Economic Growth: Panel Data Evidence from Developing Countries. Energy Policy 38 (1), 661–666. doi:10.1016/j.enpol.2009.09.005 CrossRef Full Text | Google Scholar Narayan, P. K., Saboori, B., and Soleymani, A. (2016). Economic Growth and Carbon Emissions. Econ. Model. 53, 388–397. doi:10.1016/j.econmod.2015.10.027 CrossRef Full Text | Google Scholar Özokcu, S., and Özdemir, Ö. (2017). Economic Growth, Energy, and Environmental Kuznets Curve. Renew. Sust. Energ. Rev. 72, 639–647. doi:10.1016/j.rser.2017.01.059 CrossRef Full Text | Google Scholar Panayotou, T., Peterson, A., and Sachs, J. (2000). Is the Environmental Kuznets Curve Driven by Structural Change? what Extended Time Series May Imply for Developing Countries. CAER II Discussion Paper 80. Cambridge, USA: Harvard Institute for International Development. doi:10.7916/D8CV4QJF CrossRef Full Text | Google Scholar Pao, H.-T., Yu, H.-C., and Yang, Y.-H. (2011). Modeling the CO2 Emissions, Energy Use, and Economic Growth in Russia. Energy 36 (8), 5094–5100. doi:10.1016/j.energy.2011.06.004 CrossRef Full Text | Google Scholar Paramati, S. R., Mo, D., and Huang, R. (2021). The Role of Financial Deepening and green Technology on Carbon Emissions: Evidence from Major OECD Economies. Finance Res. Lett. 41, 101794. doi:10.1016/j.frl.2020.101794 CrossRef Full Text | Google Scholar Perera, L. D. H., and Lee, G. H. Y. (2013). Have Economic Growth and Institutional Quality Contributed to Poverty and Inequality Reduction in Asia? J. Asian Econ. 27, 71–86. doi:10.1016/j.asieco.2013.06.002 CrossRef Full Text | Google Scholar Rahman, Z. U., Chongbo, W., and Ahmad, M. (2019). An (A)symmetric Analysis of the Pollution haven Hypothesis in the Context of Pakistan: A Non-linear Approach. Carbon Manag. 10 (3), 227–239. doi:10.1080/17583004.2019.1577179 CrossRef Full Text | Google Scholar Ren, X., Cheng, C., Wang, Z., and Yan, C. (2021). Spillover and Dynamic Effects of Energy Transition and Economic Growth on Carbon Dioxide Emissions for the European Union: A Dynamic Spatial Panel Model. Sust. Dev. 29, 228–242. doi:10.1002/sd.2144 CrossRef Full Text | Google Scholar Sadorsky, P. (2014). The Effect of Urbanization on CO2 Emissions in Emerging Economies. Energ. Econ. 41, 147–153. doi:10.1016/j.eneco.2013.11.007 CrossRef Full Text | Google Scholar Salman, M., Long, X., Dauda, L., Mensah, C. N., and Muhammad, S. (2019). Different Impacts of export and Import on Carbon Emissions across 7 ASEAN Countries: A Panel Quantile Regression Approach. Sci. Total Environ. 686, 1019–1029. doi:10.1016/j.scitotenv.2019.06.019 PubMed Abstract | CrossRef Full Text | Google Scholar Shafik, N. (1994). Economic Development and Environmental Quality: An Econometric Analysis. Oxford Econ. Pap. 46 (Suppl. ment_1), 757–773. doi:10.1093/oep/46.Supplement_1.757 CrossRef Full Text | Google Scholar Shahbaz, M., Gozgor, G., Adom, P. K., and Hammoudeh, S. (2019). The Technical Decomposition of Carbon Emissions and the Concerns about FDI and Trade Openness Effects in the United States. Int. Econ. 159, 56–73. doi:10.1016/j.inteco.2019.05.001 CrossRef Full Text | Google Scholar Shahbaz, M., Nasreen, S., Abbas, F., and Anis, O. (2015). Does Foreign Direct Investment Impede Environmental Quality in High-, Middle-, and Low-Income Countries? Energ. Econ. 51, 275–287. doi:10.1016/j.eneco.2015.06.014 CrossRef Full Text | Google Scholar Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does Higher Economic and Financial Development lead to Environmental Degradation: Evidence from BRIC Countries. Energy Policy 37 (1), 246–253. doi:10.1016/j.enpol.2008.08.025 CrossRef Full Text | Google Scholar Wang, Y., Liao, M., Wang, Y., Xu, L., and Malik, A. (2021). The Impact of Foreign Direct Investment on China's Carbon Emissions through Energy Intensity and Emissions Trading System. Energ. Econ. 97, 105212. doi:10.1016/j.eneco.2021.105212 CrossRef Full Text | Google Scholar Wawrzyniak, D., and Doryń, W. (2020). Does the Quality of Institutions Modify the Economic Growth-Carbon Dioxide Emissions Nexus? Evidence from a Group of Emerging and Developing Countries. Econ. Research-Ekonomska Istraživanja 33 (1), 124–144. doi:10.1080/1331677X.2019.1708770 CrossRef Full Text | Google Scholar Welsch, H. (2004). Corruption, Growth, and the Environment: A Cross-Country Analysis. Envir. Dev. Econ. 9 (5), 663–693. doi:10.1017/S1355770X04001500 CrossRef Full Text | Google Scholar Wheeler, D. (1999). Racing to the Bottom? Foreign Investment and Air Pollution in Developing Countries. J. Environ. Dev. 10 (3), 225–245. doi:10.1596/1813-9450-2524 CrossRef Full Text | Google Scholar Zeng, K., and Eastin, J. (2012). Do developing Countries Invest up? the Environmental Effects of Foreign Direct Investment from Less-Developed Countries. World Dev. 40 (11), 2221–2233. doi:10.1016/j.worlddev.2012.03.008 CrossRef Full Text | Google Scholar Zheng, S., Wang, R., Mak, T. M. W., Hsu, S.-C., and Tsang, D. C. W. (2021). How Energy Service Companies Moderate the Impact of Industrialization and Urbanization on Carbon Emissions in China? Sci. Total Environ. 751, 141610. doi:10.1016/j.scitotenv.2020.141610 PubMed Abstract | CrossRef Full Text | Google Scholar Zhu, H., Duan, L., Guo, Y., and Yu, K. (2016). The Effects of FDI, Economic Growth and Energy Consumption on Carbon Emissions in ASEAN-5: Evidence from Panel Quantile Regression. Econ. Model. 58, 237–248. doi:10.1016/j.econmod.2016.05.003 CrossRef Full Text | Google Scholar Keywords: foreign direct investment, carbon emissions, economic development, regulatory quality, moderating effects Citation: Huang Y, Chen F, Wei H, Xiang J, Xu Z and Akram R (2022) The Impacts of FDI Inflows on Carbon Emissions: Economic Development and Regulatory Quality as Moderators. Front. Energy Res. 9:820596. doi: 10.3389/fenrg.2021.820596 Received: 23 November 2021; Accepted: 13 December 2021;Published: 11 January 2022. Edited by: Xiaohang Ren, Central South University, ChinaReviewed by: Taimoor Hassan, Nanjing University of Science and Technology, ChinaYasir Khan, Anhui Polytechnic University, ChinaCopyright © 2022 Huang, Chen, Wei, Xiang, Xu and Akram. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms. *Correspondence: Fuzhong Chen, [email protected] This article is part of the Research TopicProgress Towards Achieving Cross-Regional Carbon Mitigation Targets View all 14 Articles |

【本文地址】