| $34 an Hour is How Much a Year? | 您所在的位置:网站首页 › 异维a酸会影响长高吗 › $34 an Hour is How Much a Year? |

$34 an Hour is How Much a Year?

|

Facebook

Twitter

Mix

This article may contain links from our partners. Please read our Disclaimer for more information.

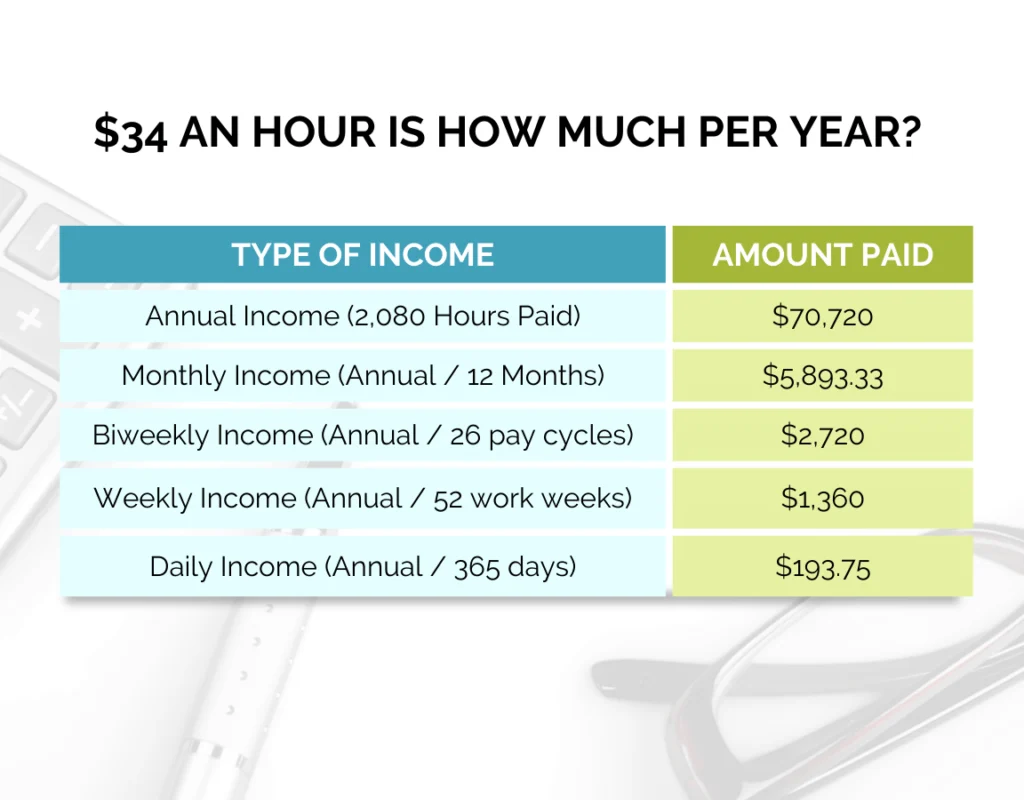

Earning an hourly wage makes it hard to budget unless you annualize it or at least look at it on a monthly basis. Knowing how much you bring in each month is important; otherwise, how do you set up a budget? You need to know how much you can commit to expenses like housing, utilities, insurance, food, and savings. If you make $34 an hour, check out our guide to make the most of it. Continue reading to also see the equivalent annual salary based on how many hours you work. Table of Contents 34 Dollars an Hour Is How Much a Year?You may find yourself asking how much is $34 an hour annually? If you work 52 weeks per year (or get two weeks of paid vacation), you will make around $70,720 assuming you work 40-hour weeks with no overtime pay. If you don’t get paid time off and you take it, you’ll work around 2,000 hours per year, bringing your salary down to $68,000 even. But if we’re honest, there are 260 weekdays in 2023. If you worked every weekday, you’d work 2,080 hours and make $70,720 annually. Let’s convert your hours worked to salary based measurements:

Check out our free Hourly to Salary Calculator to further dive into your hourly pay. For both salaried and hourly employees, the fair labor standards act, and the department of labor standards provides you with a level of protection. Federal minimum wage (minimum rate of pay for a given nonexempt job role) and for overtime hours on time-spent if an employee meets compensatory requirements are just two examples of how labor laws help you. How Much is $34 an Hour per Month?It helps to know how much $34 an hour earns you per month. You’ll have a better idea of your monthly budget and what you can spend. Using the full 365 days in 2023, the average hourly wage earner works 175 hours per month. At $34 an hour, you’d make $5,950 per month, assuming you work all the weekdays in the month. If you take time off unpaid, the amount drops. How Much is $34 an Hour per Week?Do you prefer to budget weekly? Many people do; it’s easier to break it down than look at a month at a time and get overwhelmed. $34 an hour per week means $34 an hour for 40 hours or $1360. If you work overtime or take time off, it will increase or decrease your weekly income accordingly. How Much is $34 an Hour per Day?Want to look at it from a daily standpoint? Maybe you want to give yourself a little incentive to keep going – and what works better than cold hard cash, right? If you work full-time, that’s 8 hours a day on average. At $34 an hour, you’d gain $272 a day. $34 An Hour Breakdown (Comparison Table)Here’s a quick breakdown of what $34 an hour looks like for the average person.  Tools You Need to Live on $34 an Hour

Empower

Tools You Need to Live on $34 an Hour

Empower

Knowing your net worth is half the battle, and Empower helps you understand yours. Track your assets and liabilities – see where you stand (and where you should make changes). It doesn’t cost anything unless you sign up for their Robo-advisor services, which we think is a great way to start investing, especially for beginners. A Top Wealth Management and Budgeting Tool Empower

4.7

Empower

4.7

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower! Pros: Early pay and cash advancesEasy account linkingEarn cash backBudgeting tools to monitor spending and expensesAn inexpensive way to borrow funds Cons: The amount borrowed is non-customizableRequires a subscriptionLow APYNeed an Empower card to receive free and instant cash advances Sign Up CIT BankDon’t waste your time (and moolah) in your local, brick-and-mortar banks. The interest is next to nothing – you’ll get the same result keeping things under your mattress. Instead, make it work for you at CIT Bank, where you make 11x the national average interest rates in their money market account. Earn More On Your Savings CIT Bank

5.0

CIT Bank

5.0

Earn higher and more competitive APY with CIT Bank. As a top-ten online bank, they commit themselves to growing and preserving your savings safely and securely. Find saving, e-checking, money market, and CD options with CIT. Pros: Significantly higher APY than traditional banks4.20% APY on Savings Connect AccountsZero monthly feesSmall deposit minimum requirements Cons: No physical locations are availableChecks are not an available optionNO IRAs, car loans, or credit cards Learn More FDIC insured - Rates may vary and are subject to change FlexJobsLooking for a part-time gig to pick some additional work-hours up? Regardless of whether you want to extend your workweek into the weekends or extend past your normal eight hours per day – FlexJobs offers the best remote work and flexible positions available. Kickstart Your Remote Job Search FlexJobs

4.1

FlexJobs

4.1

Find the best paying full time & part time remote work from home & flexible jobs available online! Both employee & freelance positions available from some of the biggest companies! Pros: Advanced and easily refined job searchesSaves time for job seekersFlexJobs screens the jobs they post30-Day money back guarentee Cons: Requires a membership feeSalaries are not always listed with the job postSome jobs are not actually remote Learn More TillerDo you love spreadsheets, but don’t have the time for manual data entry? Who does, right? Tiller automatically imports your transactions, working with over 20,000 banks. They even categorize for you (don’t worry you can customize) and send daily emails showing your balance and activities. Manage Your Money With Spreadsheets Tiller

3.5

Tiller

3.5

Easily automate spreadsheets with Google Sheets or Microsoft Excel and manage your finances today! Connect your transaction data, bank, credit cards, brokerages, loans, and other financial institutions and gain insight into your finances. Pros: Extremely CustomizableAdvanced reporting on personal profit, loss, and cash flow.Free for 30-days Cons: No mobile app - can only access via spreadsheetBasic knowledge of spreadsheets is requiredOnly free for 30-days Learn More Survey JunkieReceived gift cards or PayPal money just for providing your opinions and input on today’s products and services with Survey Junkie. Complete these in your free time and take home a little side money. Seriously, while you’re watching TV, waiting for the doctor, or while cooking dinner, answer a series of questions or two and acquire points for free prizes. Take Surveys, Get PAID! Survey Junkie

5.0

Survey Junkie

5.0

Get paid for taking online surveys! All you have to do is build your profile, take surveys, earn points, and get paid! Payouts are available via PayPal or e-Giftcards. Pros: Free to sign upRedeem for cash or gift cardsPoints have a long "shelf life" compared to other sites. Cons: Payouts for some surveys are low Sign Up Is $34 an Hour Good Pay?You can make $34 an hour work if you’re responsible with your finances. If you accumulate a lot of debt, even $34 an hour may not be enough to cover your expenses. Make sure you create a budget and stay intentional with your spending and saving. If you work hard to reach your goals, you’ll achieve financial freedom in no time! Financial independence has more to do with how you manage your money than how much money you make. Check out our Manage Money category for effective strategies to manage your money!  Samantha Hawrylack Samantha HawrylackSamantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches. Facebook Twitter Mix |

【本文地址】